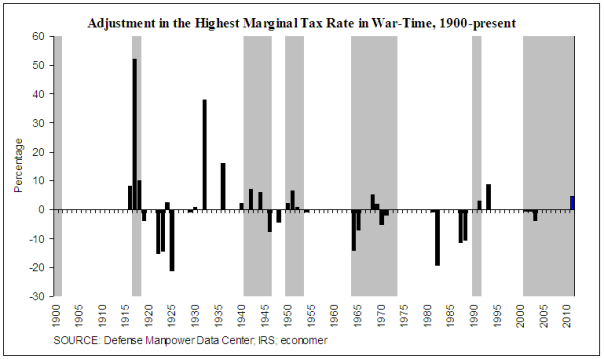

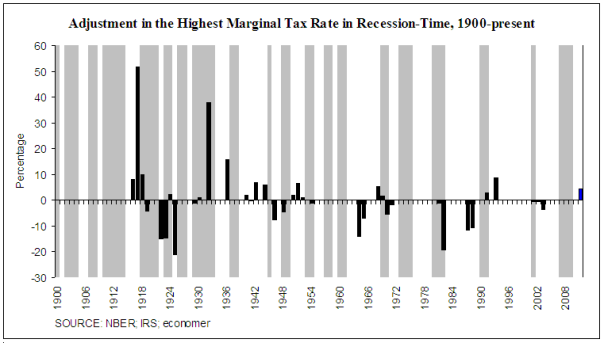

Raising and lowering of the highest marginal tax rate is considered here-in relating to the U.S. from 1913 to present day. Against the backdrop of 8 years of war in Iraq and 9 years in Afghanistan, more specifically considered are the precedents of past presidential administrations established in the context of cutting and lowering the highest marginal taxes in war-time and recession-time. Presidents Wilson and Roosevelt are forerunners in terms of Democrats having cut taxes in recession and war times, respectively; whereas, Presidents Harding and Nixon are forerunners in terms of Republicans having cut taxes in recession and war times, respectively.

Since 1913, after ratification of the 16th Amendment, the United States offered an official income tax on various progressive levels of wage-earnings. For instance, in the beginning, the Internal Revenue Service (IRS) charged 1 percent on the lowest tax bracket range and 7 percent on the highest tax bracket range. Over time these taxation targets have changed widely from one administration to the next. For instance, Franklin Roosevelt and Harry Truman presided over the highest level of top marginal tax rate at 94 percent in 1944-45. Typically, Democrats are categorized as having raised such taxes consistently through time. In reality, there is ample variation among presidencies and party affiliations.

In the political press literature, for instance, sometimes referenced are Kennedy-Democrats and Eisenhower-Republicans, self-described, in order, as Democrats who agree with lowering taxes and Republicans who agree with raising taxes. Today, Ben Stein, the economist, columnist and comedian, calls himself an Eisenhower-Republican, for instance, disagreeing with fringe economic theory such as The Laffer Curve and gross categorizations pertaining to Republicans such as the stereotype that Republicans are always against taxation. President Eisenhower (R) presided over the higher corporate income tax rates having occurred from 1952-1963. President Kennedy (D), on the other hand, is noted for having been the impetus behind the 1964 tax cut.

The Eisenhower-Republican:

One can make out in the graphics below that over the years of Dwight Eisenhower’s presidency he lowered the highest marginal tax rate once in 1954, albeit from the 92 percent Truman-inherited level, down one percentage point to 91 percent. The Korean War unfolded over that particular term, coinciding with years 1950-53. Evidently, Eisenhower, Truman and others understood the required revenues and shared sacrifices required of American civilians for the purposes of funding the major “military-industrial complex” in war-time, as President Eisenhower referred to it in his Presidential Farewell Address to the Nation on January 17, 1961.

Regarding the Obama administration, President Obama intends to raise the highest marginal tax rate in 2011 from the current level of 35 percent to 39.6 percent – read Tax Day 101: How is the tax code changing under Obama? In the provided graphics, that estimate is included in blue. Meanwhile, Treasury Secretary Tim Geithner is managing to keep quiet regarding past, present and future tax seasons. Geithner suffered very little consequence, other than embarrassment, after having been caught for not paying taxes when he was employed at the International Monetary Fund (IMF) in the early 2000s. In peak irony, we actually rewarded him instead with leadership of the IRS, the official agency in charge of collecting tax revenues – read Geithner’s Tax History Muddles Confirmation.

Considering precedents, it is now time to identify the trend setters for cutting and hiking tax burdens in times of recession and military conflict — that is, the originators.

President George Bush, the younger, and his administrational cutting of the highest tax percentage most recently in 2001, 2002 and 2003 is surprisingly rejected as being precedent setting. Originally speaking, Franklin Roosevelt, the World War II-presiding Democratic president, represents the first president to lower the highest marginal tax rate in 1941. Republican Richard Nixon, having served as president during Vietnam military engagement, provided Republican party precursor legacy to the Bush war-time tax cuts. Recall Nixon famously declared himself and his policymakers to be Keynesians in 1971. According to the data, the highest marginal tax rate under Nixon was relaxed 1.8 percent in 1971 relative to the previous year.

For the underlying dataset regarding recessions, presidencies, wars and highest marginal tax rates – click DATASET.

Regarding tax cuts during a recession, the ultimate precedent belongs to Democratic President Woodrow Wilson, leading advocate for the League of Nations that foreshadowed the United Nations. During the 1919 recession begun 1918:Q3, Wilson lowered the highest marginal tax rate 4 percentage points from 77 percent to 73 percent by year close. That Keynesian act, using fiscal policy intervention in the form of tax level reduction, predated any formalized IS-LM framework as derived by John Keynes and John Hicks. The largest marginal tax reduction in year-to-year terms occurred in the post-Keynes era, under President Ronald Reagan, inspired by pencil scrawl on the back of a napkin, with the 19.1 percent reduction of the highest marginal tax rate in 1982.

The permanent income hypothesis authored by Milton Friedman, the Chicago economist, inspired Reagan to act on his convictions toward implementing sustained tax reductions in consecutive years, note 1981 and 1982 in the graphics; motions echoing the rational expectations theory inscribed by Robert Lucas, another Chicago economist.

The Republicrat Criticism:

Depending on one’s opinion of cutting tax levels in a time of prolonged military conflict, apparently, there is at least one significant, structural accuracy to the so-called “Republicrat” hybrid criticism pinned against the two major parties. Independents and Libertarians have long been critical of the major parties. They argue that the two major parties are not consistently, if at all ever, legitimately different from one another regarding major policy issues. Political thouroughbreads Ralph Nader, Bob Barr and Ron Paul have arguably been most prominently critical of the major parties concerning their control over arrangement of the quad-annual televised presidential debates.

The USA Today on September 25, 2008 granted platform, albeit an abbreviated one, to Nader (I) and Barr (L) in their Opposing Views column: Opposing Views by Ralph Nader, September 25, 2008 and Opposing Views by Bob Barr, September 25, 2008.

Median voter-targeted campaign strategies and lobbyist funding advantages are likely the core explanations for successes from the major parties in effectively thwarting such criticisms, according to political science theory and economic theory regarding oligopoly. More pointedly, the establishment of the two-party controlled corporate — Commission on Presidential Debates — has long been effective in biasing the qualification polling requirements required of outside independents interested in debating the larger party delegates in nationally televised forums.

According to Gallup polling, independents have been polling larger shares of the overall party affiliation pyramid. The April 2010 Party Affiliation Gallup Poll, for instance, currently states that 42 percent of surveyed Americans are polling independent, up from 36 percent in April 2007, prior to the beginning of the 2007:Q4 Sub-Prime Recession.

Another Gallup article entitled “Uninsured Americans Skew Independent Politically” discovers, “Nearly half of the uninsured, compared with roughly a third of Americans with private insurance or Medicare, are politically independent.” According to those Gallup’s March 2010 poll results, the number of uninsured Americans preferring political independence is approximately 48 percent.